Securing biotech funding in today’s environment is more competitive and complex than ever before. From early discovery to proof-of-concept, investors expect more than promising science. They want clarity, confidence in the strategy and team, and a plan that minimizes risk and maximizes potential.

Bio Venture Catalyst

Accelerate your path to funding with a strategic partner trusted by investors

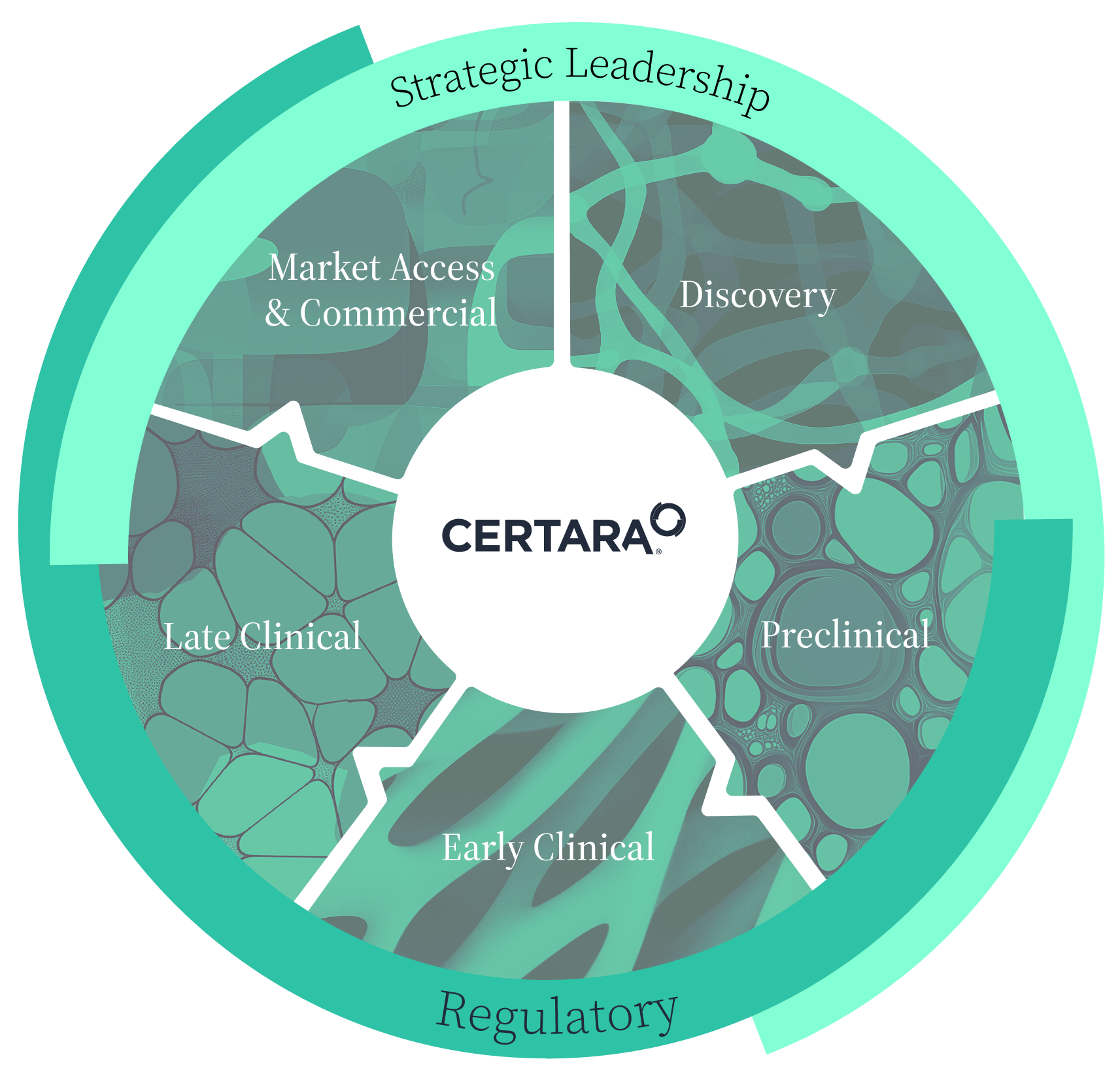

Catalyze your fundraising and shape a successful development trajectory with Certara’s integrated approach.

Learn more about Bio Venture Catalyst

Biotech success from investment to IND and beyond

Certara’s Bio Venture Catalyst solution, combined with our Strategic Early Development and Due Diligence support, forms a powerful, integrated continuum that helps emerging biotechs gain investor confidence and efficiently make smarter decisions across critical milestones. From initial investment through IND, early clinical development and beyond, we help shape the success trajectory of your program from the start.

What is holding biotech start-ups from reaching their full potential?

High cost, high stakes

Early-stage programs require significant upfront investments and funding that must stretch across multiple complex, high-risk activities.

Long timelines, cautious investors

Extended development cycles test investor patience and risk tolerance. Uncertain returns and long pathways to clinical proof of concept make funding harder to secure without a compelling, derisked strategy.

Stand out or fall behind

In a crowded funding landscape, differentiation is everything. You need clear, compelling proof-of-concept data to rise above the noise and win investor attention.

No strategy, no momentum

Lack of expert guidance can stall even the best ideas. Without access to experienced advisors and cross-functional insight, early-stage programs risk costly missteps.

What it takes to win investor confidence

In a market that rewards clarity and credibility, success means:

- Choosing the right asset, one backed by a strong scientific and business case

- Demonstrating a clear path to value creation with differentiated positioning

- Laying out an executable, milestone-driven, integrated development plan with anticipated funding needs

- Assembling trusted advisors and leadership with domain expertise

- Building investor-ready materials rooted in real-world experience and data

Certara delivers all of this in one integrated offering, giving you the strategic force multiplier you need to move with confidence from concept to clinic.

Meet our Bio Venture Catalyst experts

Related resources

View allContact Certara to accelerate early-stage success

Partner with Certara to build an investor-ready, scientifically sound, and strategically aligned early development program. From shaping your foundational roadmap to providing objective due diligence support, our experts deliver integrated solutions that drive smarter decisions, reduce risk, and prepare you for successful fundraising and first-in-human milestones.

Frequently asked questions

How does Certara help emerging companies secure biotech funding?

Certara’s Bio Venture Catalyst, combined with early development and due diligence support, helps biotech startups build investor-ready strategies that clearly demonstrate scientific innovation, commercial potential, and risk mitigation, key factors that attract and accelerate biotech funding.

What challenges do biotech startups face in securing funding, and how can Certara’s solution help?

Biotech startup funding is often hindered by high costs, long timelines, and cautious investors requiring clear, compelling evidence of value. Certara provides an integrated approach that combines market insights, data-driven development roadmaps, and objective due diligence to de-risk programs and creates a more compelling biotech investment strategy.

How does Certara’s Bio Venture Catalyst integrate with early development and due diligence services to support biotech investment strategy?

Our solution forms a seamless continuum, from crafting a strong scientific and business case to validating development plans with independent due diligence. This integration ensures your biotech investment strategy is grounded in robust data, regulatory foresight, and market differentiation, accelerating your path from concept to clinic.

Why is a strategic, investor-ready plan critical for successful biotech funding?

In today’s competitive funding environment, investors look beyond promising science to clarity, confidence, and an executable plan. Certara helps biotechs develop a clear value proposition, milestone-driven roadmap, and credible evidence package components essential for a winning biotech investment strategy that maximizes funding potential and partnership opportunities.