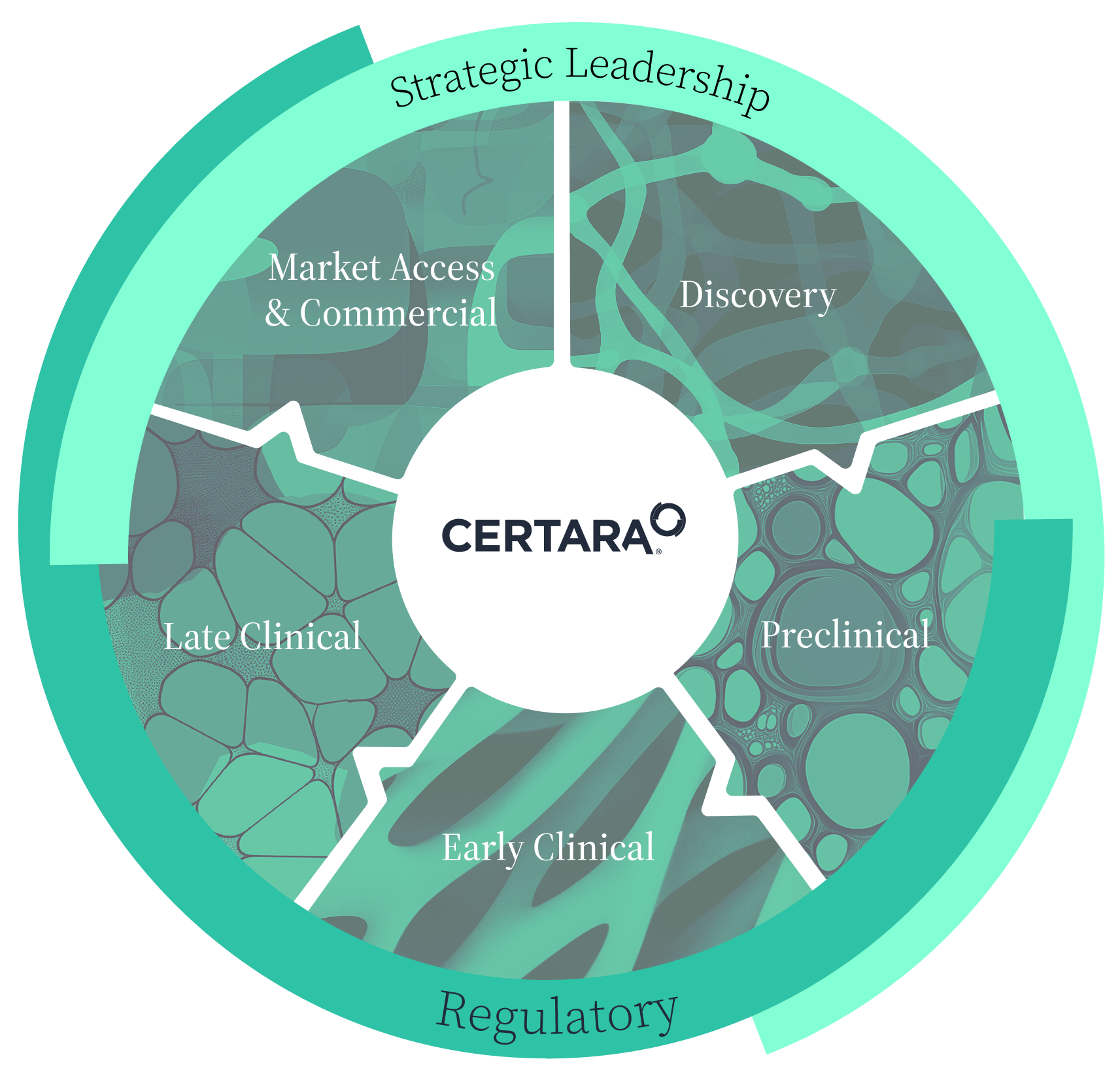

In an increasingly competitive and complex biopharma landscape, making the right investment decisions has never been more critical or more challenging. Promising assets can fail to deliver if overlooked risks, regulatory hurdles, or development gaps are not uncovered early. That’s where Certara comes in.

We partner with venture capitalists and investment firms to evaluate biopharma assets through a multidimensional lens, spanning scientific, regulatory, clinical, and commercial potential. Our mission? To help you find the hidden gems, mitigate risk, and maximize returns by informing your decisions with deep domain expertise and best-in-class tools.