October 6, 2025

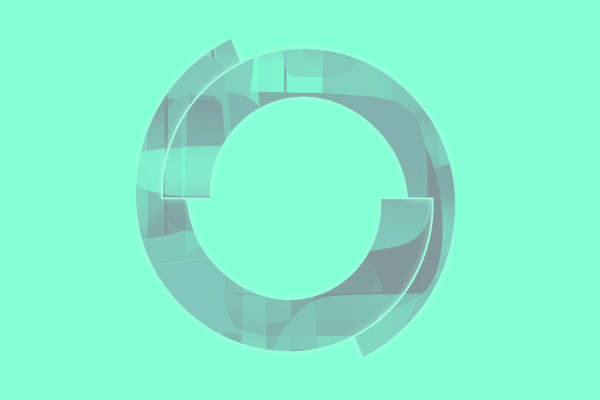

Case studies illustrating impact of international reference pricing (IRP)

Approximately 8% of products were withdrawn after the AMNOG process (Germany’s early benefit assessment that drives drug pricing), likely due to prices deemed commercially unviable1

- Within a 6-year period, manufacturers chose not to launch 11 different products to avoid expected low prices2

- Reduced access to therapy as only 29% of new products are reimbursed with another 17% having limited availability

Summary of potential MFN impact on market access & planning

Early launch markets with lower list prices, such as France and Poland, could experience access delays and/or strategic withdrawals

Manufacturers could prioritize higher-priced markets, such as Switzerland

Small and lower income markets could be disproportionally impacted, undermining equitable access to innovative therapies

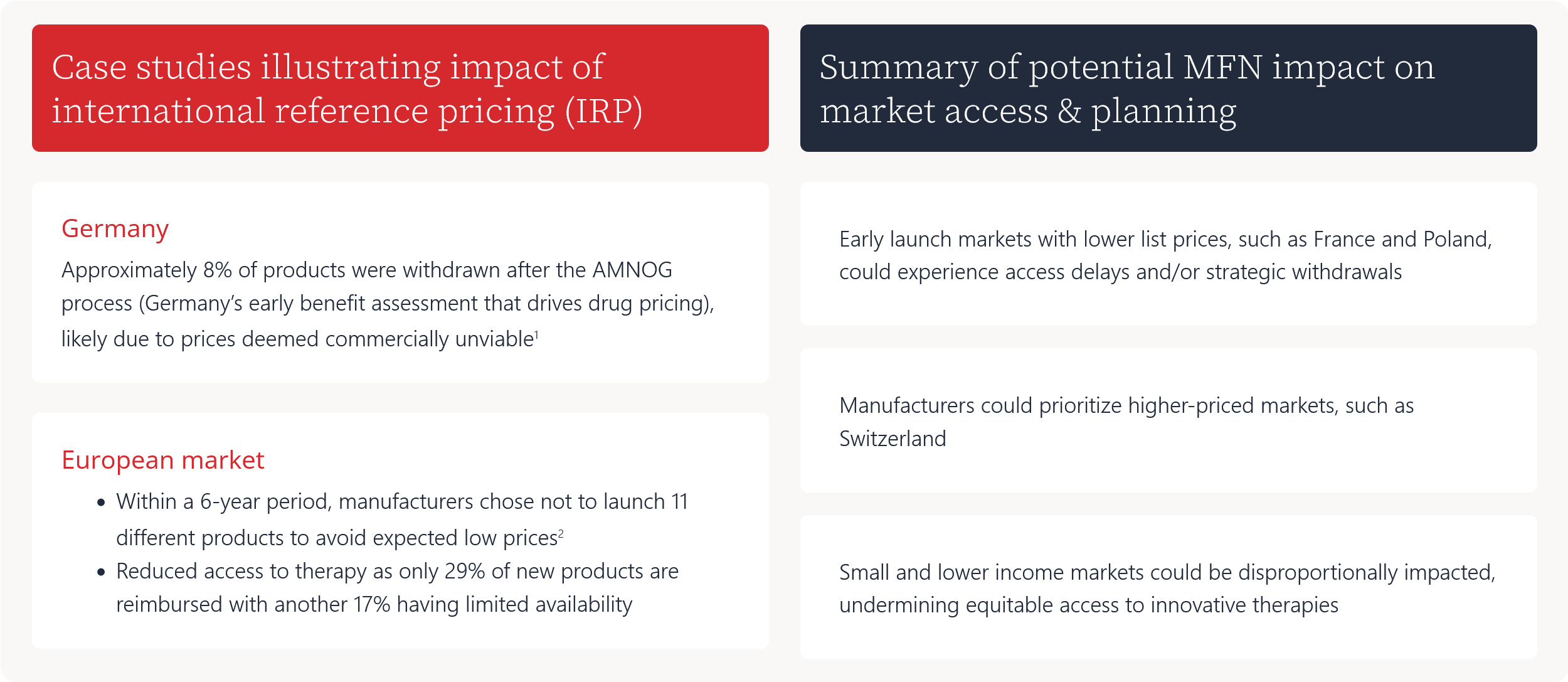

Case studies illustrating impact of international reference pricing (IRP)

Reported supply shortages due to wholesaler exploitation of price differentials4

Summary of potential MFN impact on market access & planning

Potential uptick in parallel importation as list prices increase in reference countries, leading to a greater risk of shortages in lower-priced markets

Pharma manufacturers’ internal forecasting becomes increasingly complex

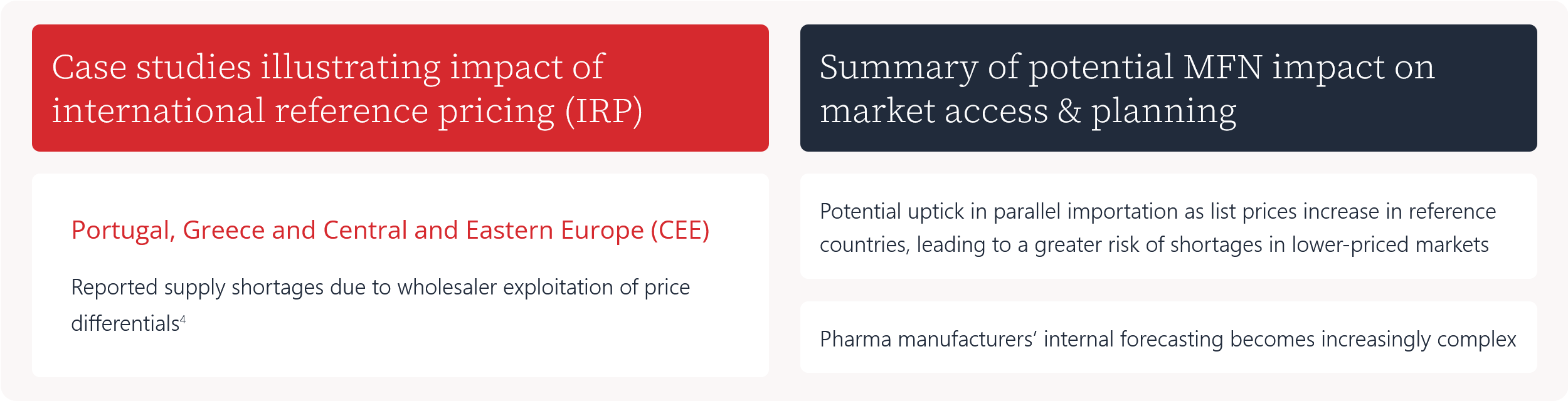

Case studies illustrating impact of international reference pricing (IRP)

- When IRP was implemented in EU markets, the industry responded with “list price corridors” to protect profits5

- List prices converged to high-income markets, i.e., France and Germany5

- In April 2025, CEOs of Novartis and Sanofi proposed an EU-wide list price “within range of U.S. net prices” and adjusted via rebates6

Summary of potential MFN impact on market access & planning

Rising affordability challenges in less wealthy countries

Industry would seek to achieve list prices in designated references countries that fall within the range of the U.S.

Prices may still diverge over time as U.S. prices increase in line with the consumer price index

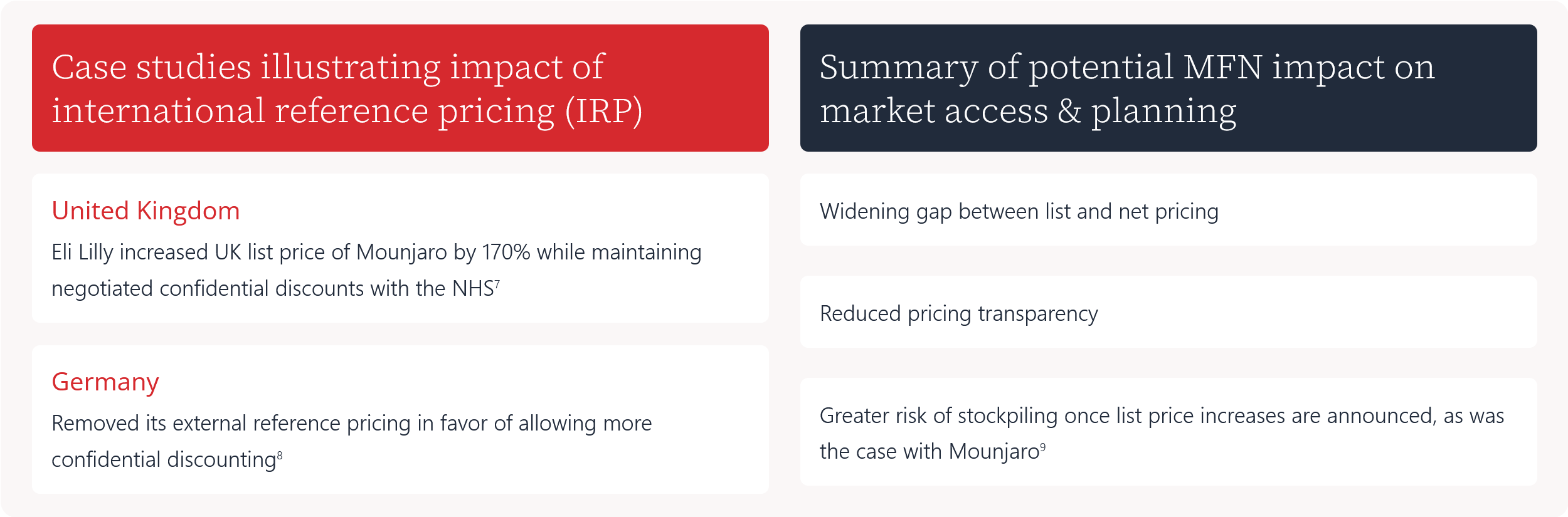

Case studies illustrating impact of international reference pricing (IRP)

Eli Lilly increased UK list price of Mounjaro by 170% while maintaining negotiated confidential discounts with the NHS7

Removed its external reference pricing in favor of allowing more confidential discounting8

Summary of potential MFN impact on market access & planning

Widening gap between list and net pricing

Reduced pricing transparency

Greater risk of stockpiling once list price increases are announced, as was the case with Mounjaro9

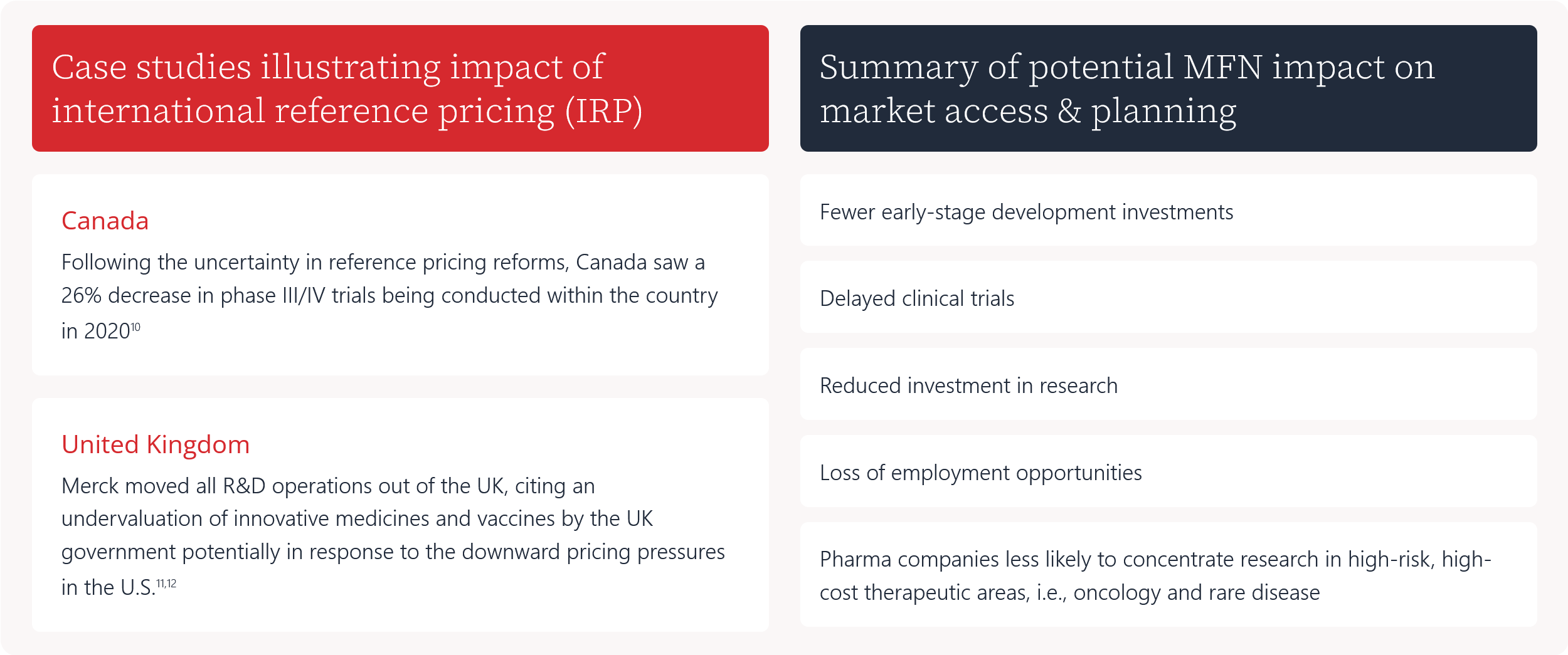

Case studies illustrating impact of international reference pricing (IRP)

Following the uncertainty in reference pricing reforms, Canada saw a 26% decrease in phase III/IV trials being conducted within the country in 202010

Merck moved all R&D operations out of the UK, citing an undervaluation of innovative medicines and vaccines by the UK government potentially in response to the downward pricing pressures in the U.S.11,12

Summary of potential MFN impact on market access & planning

Fewer early-stage development investments

Delayed clinical trials

Reduced investment in research

Loss of employment opportunities

Pharma companies less likely to concentrate research in high-risk, high-cost therapeutic areas, i.e., oncology and rare disease

Learn more about Certara’s Market Access, Pricing and Reimbursement services

Need help assessing the potential impact of the ‘Most Favored Nation’ drug pricing policy? Certara’s Market Access, Pricing and Reimbursement experts are standing by to offer their perspective as you consider strategies across your global portfolio.

Frequently Asked Questions (FAQs)

What is international reference pricing in pharmaceuticals?

International reference pricing (IRP) is a cost-control mechanism where a country benchmarks its drug prices to those in other countries, often selecting the average or median price among reference markets. The U.S. “Most Favored Nation” executive order is a proposed version of this approach but instead references the lowest price.

How does the Most Favored Nation policy differ from existing international reference pricing models?

While most countries use IRP in some form, the MFN policy is more aggressive; it directly ties U.S. prices to the lowest available price in comparable countries, with fewer guardrails to balance affordability and innovation.

What does the MFN policy mean for pharmacy benefit managers (PBMs)?

The MFN approach, coupled with direct-to-patient programs facilitated through TrumpRx, a new government-run website where U.S. consumers can search and be redirected to purchase the discounted medicine directly from the manufacturer, could shift prescription volume away from PBMs and traditional health plans, disrupting current reimbursement and distribution models.

What are the unintended consequences of international reference pricing?

Potential consequences include delayed launches in lower-priced markets, product withdrawals, parallel trade leading to supply shortages, increased confidential discounting, and reduced global R&D investment.

How could the MFN policy impact pharmaceutical market access strategies?

Companies may prioritize launches in higher-priced markets, delay entry in lower-priced countries, or restructure pricing corridors to protect U.S. revenues. Market access teams will need to adapt launch sequencing and pricing negotiations accordingly.

Senior Analyst

Jamie Thon, MSc is a Senior Analyst within Certara’s Evidence and Access Group. She joined Certara in 2025 and brings experience in pharmaceutical market access strategy, pharmacology, and research in both academic and commercial settings.

Prior to joining Certara, Jamie was a Market Access Associate at a Canadian market access consultancy firm, where she assisted pharmaceutical manufacturers in optimizing reimbursement outcomes. She has worked across a broad range of therapeutic areas, including oncology, cell and gene therapy, rare diseases, and ophthalmology. She also conducted detailed market landscape assessments and provided strategic recommendations tailored to internal business objectives and external policy trends.

Jamie holds an MSc in Applied Clinical Pharmacology from the University of Toronto, where she gained advanced training in drug development, clinical trial design, pharmacodynamics and pharmacokinetics. During her time there, she served as a teaching assistant and completed research at the Center for Mental Health and Addiction (CAMH) on novel cannabinoid biomarker methodologies. She earned her BSc in Biomedical Sciences from McGill University, majoring in Microbiology and Immunology with a minor in Pharmacology.

References

1. Schröder L, Glüsen M, Heinrich Schoppmeyer L, Kielhorn H. How To Preserve Patient Access in Germany – a Performance Analysis of Products That Are no Longer Available on the German Market. ISPOR. Nov. 2024. ispor.org/docs/default-source/euro2024/isporeurope24schroederhta123poster145940-pdf.pdf?sfvrsn=1475c3ee_0

2. Kanavos P, Fontrier AM, Gill J, Efthymiadou O. Does external reference pricing deliver what it promises? Evidence on its impact at national level. Eur J Health Econ. 2020 Feb;21(1):129-151. doi: 10.1007/s10198-019-01116-4. Epub 2019 Oct 3. PMID: 31583483; PMCID: PMC7058621.

3. “Most-Favored Nation” Drug Pricing Strategy May Backfire, New Research Warns. 03 Sep 2025. ISPOR. www.ispor.org/heor-resources/news-top/news/2025/09/03/most-favored-nation–drug-pricing-strategy-may-backfire–new-research-warns

4. Nolen, N., & Balling, S. (2021, May 11). Parallel Trade of pharmaceuticals and its problems in the EU. Centrum für Europäische Politik. cep.eu/fileadmin/user_upload/cep.eu/Studien/cepInput_Parallelhandel/cepInput_Parallel_Trade_of_Pharmaceuticals_and_its_Problems_in_the_EU.pdf

5. Referencing Drug Prices of Other Countries May Not Sustainably Lower Prices in the United States: Lessons From Europe. Grueger, Jens et al. Value in Health, Volume 28, Issue 9, 1305 – 1308

6. Fick, M. European pharma companies push for higher drug prices in EU amid U.S. tariff threats. Reuters. https://www.reuters.com/business/healthcare-pharmaceuticals/novartis-sanofi-ceos-say-eu-should-raise-drug-prices-face-tariffs-2025-04-23/

7. Almeida L. Eli Lilly ramps up UK price of weight loss jab Mounjaro after Trump demands. The Guardian. 15 Aug 2025. theguardian.com/business/2025/aug/14/eli-lilly-uk-price-weight-loss-jab-mounjaro-trump

8. Melck B. All change in Germany – confidential pricing in, IRP out. Pharmaceutical Technology. 31 Jan 2025. pharmaceutical-technology.com/analyst-comment/all-change-germany-confidential-pricing-irp/

9. Kansteiner F. Eli Lilly pauses UK Mounjaro orders ahead of price hike, citing stockpiling concerns. Fierce Pharma. 28 Aug 2025. fiercepharma.com/pharma/eli-lilly-pauses-uk-mounjaro-orders-ahead-september-price-hike-citing-stockpiling-concerns

10. Rawson, Nigel SB (2021). Clinical Trials in Canada Decrease: Worrying Signs that PMPRB will Impact Research Investment. Canadian Health Policy, Feb 2021. ISSN 2562-9492 www.canadianhealthpolicy.com

12. Dunleavy K. Merck executes its own Brexit, moving all R&D operations out of UK. Fierce Biotech. 10 Sep 2025. fiercebiotech.com/biotech/merck-executes-its-own-brexit-moving-all-rd-operations-out-uk

11. Kollewe J. Big pharma will stop investing in UK, top scientist warns after Merck’s £1bn exit. The Guardian. 11 Sep 2025. theguardian.com/business/2025/sep/11/big-pharma-will-halt-investments-in-uk-warns-eminent-scientist-sir-john-bell

Contact our market access and pricing experts