If you work at a biotechnology start-up, you’re probably excited about your compound assets, particularly if your development program has a single asset. Unfortunately, navigating the ocean of opportunity can become more of a pain than a blessing, especially when your disease area has significant investor activity. Focusing your excitement is essential! It’s beneficial to understand the scientific foundation your asset is best set up to negotiate. Knowing what your molecule is capable of requires a commitment to what’s possible and importantly, what’s not. That’s where a target product profile (TPP) comes in.

Creating a TPP is a simple activity that can help you understand the value proposition of your discovery assets. Some may dismiss this as a tool created to filter assets in companies with large pipelines and limited resources to take everything forward, and some may say “Let’s just go with the flow.” But, failing to optimize a TPP means missing an opportunity to learn more about your asset, understand its competitive landscape, and strengthen the rigor of scientific inquiry and experimentation to support a robust clinical development plan.

What is a target product profile?

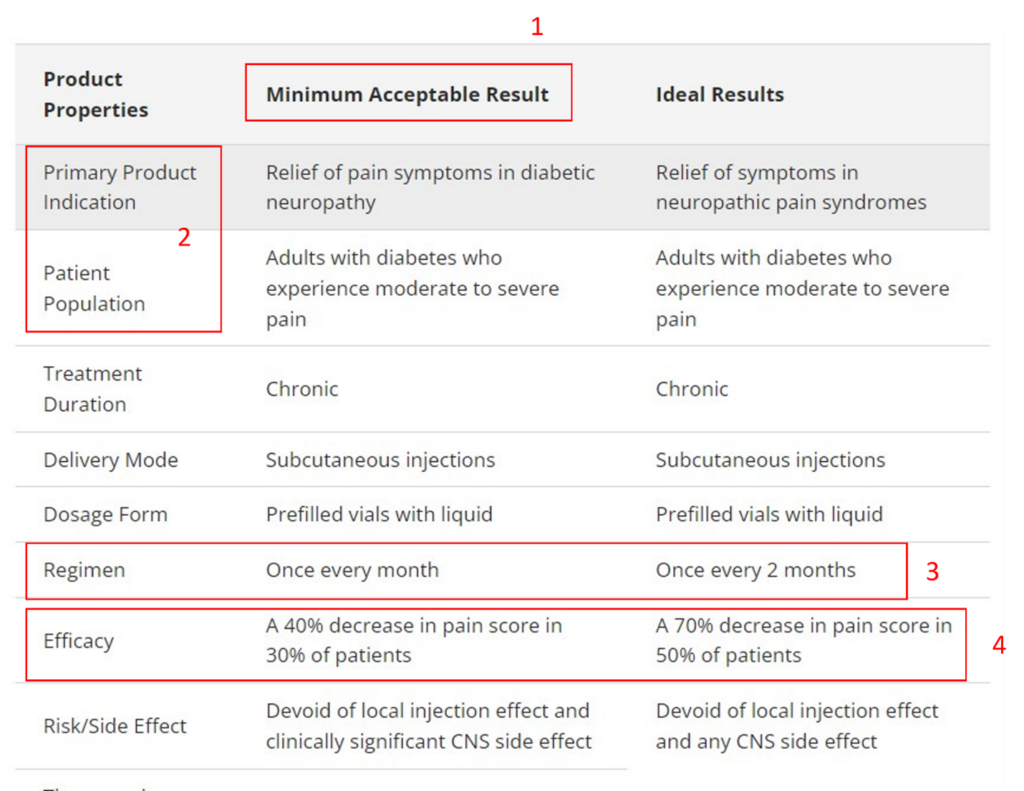

It’s a system of key factors that illustrates the base case and worst-case scenarios for various development attributes that can aid in understanding what the return on investment or developability of your asset will be. Figure 1 shows an example of a target product profile.

Figure 1: A basic target product profile with highlighted boxes (Adapted from CREATE Bio Example: Target Product Profile )

Let’s dissect the four red boxes above. The example TPP is for a molecule to treat pain associated with diabetic neuropathy.

Key consideration 1: Understand what’s minimally acceptable.

One benefit of developing a target product profile is defining what’s minimally acceptable. This is often the most debated part of the exercise and requires understanding where the asset falls in the therapeutic armamentarium and the regulatory requirements for drug approval. The challenge is that this profile is being developed for a product that may materialize years in the future, so it requires guessing what the field will look like. For an immune checkpoint inhibitor, understanding what the field will look like in 2 years is impossible. However, the example used above is somewhat easier to configure.

Key consideration 2: Know your patient population.

Another key consideration is understanding the asset’s patient population and, especially, its primary indication. This consideration gives the greatest focus to the discovery team. You may have an immune modulator that can be helpful in multiple immunology-based diseases. However, it’s crucial in the discovery space to allocate your limited resources to elucidate the proof of biology. Understanding what your target engagement biomarkers are and how they change the course of disease progression is critical.

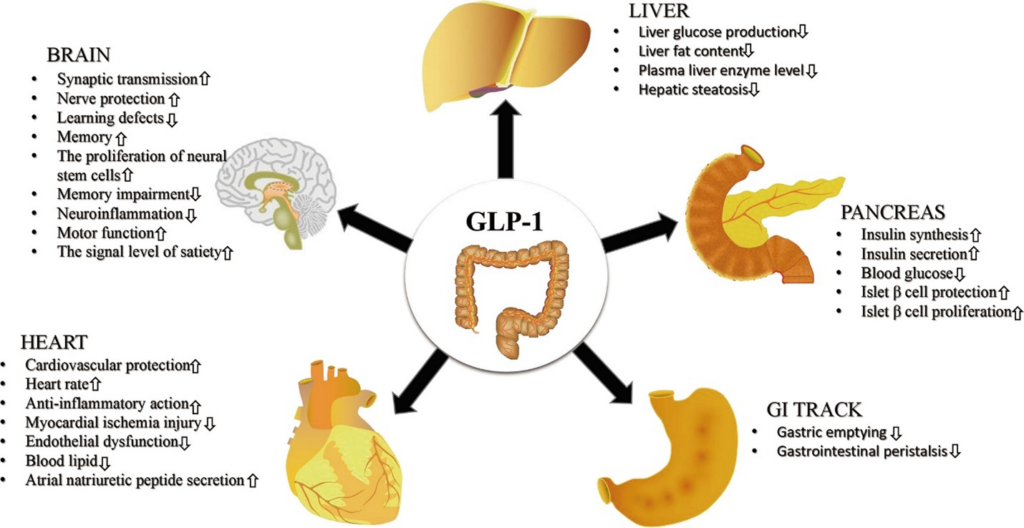

Let’s take the example of a GLP1 agonist, which is a common target of diabetes and anti-obesity drug programs. Figure 2 shows the myriad physiological effects a GLP-1 receptor agonist (Glucagon-like peptide-1; GLP-1 RA) can modulate.

Figure 2: System-wide effects of GLP-1 receptor agonists (Adapted from Zhao et al., 2021. URL: https://www.frontiersin.org/articles/10.3389/fendo.2021.721135/full).

If you’re developing such a molecule, you will need to develop a strategy for a primary indication which may be the fastest possible route to approval and patient access or a route that helps make the most of the available data for GLP1 RA. Choose the primary indication based on pharmacology data. A cardiovascular study looking at acute effects may be simpler to perform compared to assessing satiety.

Key consideration 3: Choose the dosing regimen.

Why focus on dosing so early in the discovery and translational development phase? If, for example, the standard-of-care options are cluttered with parenteral injections, a more convenient dosing regimen, and route may be commercially more desirable. Some dose regimen considerations depend on formulation feasibility. Those that require modifying the pharmacokinetic profile have the longest lead times in development.

Key consideration 4: Define the thresholds of efficacy.

Another key consideration is understanding the threshold of efficacy. This is more straightforward when you have a validated drug target, and a plethora of information is available on surrogate endpoints and outcomes. However, if you are developing an asset without a standard of care, then things can get trickier. You may have to draw on the expertise of scientific key opinion leaders to understand what effect could be clinically meaningful. It may also require engaging with regulators to see if the thresholds you aim for are viable from their perspective.

Mitigating factors for this consideration are a battery of biomarkers that you may have identified, an understanding of the natural history of the disease you are targeting, as well as some idea of how your drug is intended to work. Some guestimate is probably workable. As you accrue more data and information, and your assumptions change, this threshold may also change. Either way, it gives you a target to aim for.

The target product profile is a living document. It travels with the development plan, and parts of it can change. However, the TTP allows developers to remain focused and committed to asset development. As the TPP matures, it can continue its path toward financial valuation, due diligence, as well as licensing constructs. Some companies with large product portfolios use the TPP to measure the probability of scientific and regulatory success. As a management tool, the TPP can also break gridlocks that may occur in smaller companies where there is a call to either take the molecule forward or kill it prematurely. The TPP is a simple tool that is transparent and phase-appropriate; its use in pharmaceutical decision-making is limitless!

Read this blog for information about the importance of an Integrated Development Plan (IDP), including how an IDP relates to the Target Product Profile and the Clinical Development Plan (CDP).

For further development insights, visit my blog space: Blog Roundup.

References for further reading

- Bach PB. Indication-specific pricing for cancer drugs. JAMA. 2014;312:1629–1630.

- DiMasi JA, Feldman L, Seckler A, Wilson A. Trends in risks associated with new drug development: success rates for investigational drugs. Clin Pharmacol Ther. 2010;87:272–277.

- Guo R-J, Lev B, Zhou N. The valuation of biotech IPOs. J Acc Audit Financ. 2005;20:423–459.

- Hermosilla M. Rushed innovation: evidence from drug licensing. Manag Sci. 2020;67:257–278.

- Michaeli DT, Yagmur HB, Achmadeev T, et al. Value drivers of development stage biopharma companies. Eur J Health Econ. 2022 doi: 10.1007/s10198-021-01427-5.