Compared to several other developed countries, Americans pay more for worse health care outcomes. A recent JAMA study found 20% – 25% of all US health care spending is wasteful.1 In addition, medical inflation is a massive concern. And, unlike most other developed countries, our current insurance system has patients pay a high price for these excesses. Scott Gottlieb, while still FDA Commissioner, called the status-quo a “Kabuki theatre”2 where the “sick are subsidizing the healthy.” The situation is driving a boom of personal insolvencies due to medical costs.

In this environment, the drug-price watchdog, the Institute for Clinical and Economic Review (ICER), published this month their Report on Unsupported Price Increases.3 The report picked seven innovative medicines that, in their view, have seen unjustified price hikes. While the study made the headlines, how sufficient is ICER’s analysis?

Unfortunately, ICER’s report is fundamentally flawed. First, selecting seven medicines with price increases as evidence of unsubstantiated price hikes ignores the micro- and macroeconomics of pharmaceutical innovation. Individual companies must price drug successes high to sustain drug development failures. On the macro-level, patents purposefully protect market monopolies in a societal contract where generics enter the market at a fraction of the innovator’s cost once brand exclusivity ends. Generally, this societal contract has worked in the US: at least 8 out of 10 of prescriptions filled today are for generics.

Moreover, the report’s analysis is problematic. ICER miscalculated the price manufacturers actually realized from the drugs selected for their report. When the researchers found at least a dozen cases yielding a net price above the (gross) list price, or WAC, they removed the list prices for those products. But, they continued with the flawed methodology for all other drugs as if the inability to properly calculate the net prices only pertained to the extreme case where net (somehow) came out higher than gross. Consequently, at least one company disclosed to ICER that net price changes for the assessed products were, in fact, negative. Meaning, the innovator made less money on the branded medicine than in the prior year. Unfortunately, ICER ignored that correction which would invalidate its methodology. Then, the report proceeded to cite the list price increase, which ICER had misestimated, not the decrease that occurred. Excluding countervailing evidence is unprincipled and violates a crucial research tenet: reproducibility.

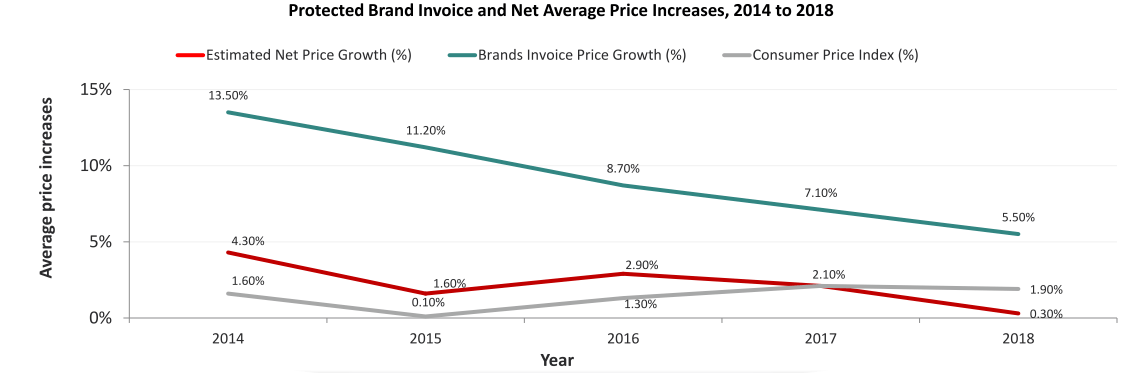

But, what happened to list prices? Concerns around drug price inflation have produced data on how much value pharma companies capture. Such research contradicts the ICER narrative and continues to be ignored across their work. Net price increases are estimated to be below medical inflation (data above from IQVIA). Moreover, Express Scripts, one of the nation’s largest Pharmacy Benefits Managers (PBM), found that spending on medicines in commercial insurance plans grew just 0.4% in 2018 net of rebates and discounts— the lowest in 25 years. Why does this matter? If list prices climb and net prices stay below inflation, it is the “Kabuki theatre” of reimbursement and rebating that is being subsidized. A win for PBMs perhaps, but neither patients nor drug manufacturers see any gains. And, if pharma applied modest price increases, what happened to the unjustified price hikes ICER claims to have uncovered? Suddenly, the story would become much less egregious.

The ICER report’s stated objective was not to evaluate the evidence base, nor to establish what a value-based price for these drugs would be.

“It is important to note that ICER does not have the capacity to perform full economic analyses on the nine therapies evaluated in this report, nor would the time needed to develop full ICER reports (at least eight months) provide information in a useful timeframe for the public and policymakers. Therefore, this report is not intended to determine whether a price increase for a drug is fully justified by new clinical evidence … “- Page ES2

What should we conclude from their analysis then? The report’s goal was to determine whether “substantial new evidence existed that could justify [sic]” a price increase. Confused? It’s for a good reason! If the report has the limitation of “not being able to determine whether a price increase is justified,” it cannot be titled “Report on Unsupported Price Increases.” ICER is openly contradicting its own analysis with the stated limitation.

What ICER went on to do is worrisome and matters even more. It asked manufacturers for additional evidence on their drugs. The manufacturers complied with this request only to see ICER selectively ignore dozens of studies and hundreds of literature references that fell into the ICER-chosen assessment window. “Outside of our scope” appears 92 times in the 125-page document. The scope determined the analysis, and it was at best highly restrictive and at worst entirely flawed to answer the research question. ICER admits to discounting many publications, but it’s unclear what qualified discounting in the first place. For instance, many studies showed improvements in quality of life benefits and leveraged real-world evidence on the products ICER selected.

Many have demanded the pharmaceutical industry to become more patient-centered. Now that it is, we cannot just dismiss any real-world evidence that runs counter to our hypothesis as “low-quality.” To be clear, we can’t determine to what degree ICER had done this with the evidence it had received. But, its restrictive approach differs from the FDA which now considers these evidence types as meaningful endpoints, even for approval. And, it differs from payers who want evidence for the real-world patient effectiveness of drugs, not just controlled trial data. ICER further validates the growing concern among patient associations who have long challenged the group on its disinterest in incorporating patient perspectives. ICER dismissed peer-reviewed articles published in scientific journals and posters presented at established conferences. Should ICER unilaterally determine what counts as medical progress across a variety of therapeutic areas? Even when ICER produced its more complete analyses, stakeholder concerns have surfaced. For instance, CVS suggested basing its formulary on ICER’s value assessments in 2018. The resulting backlash from patients and doctors was enormous, and CVS did not proceed with the plan.

We cannot identify obvious research flaws without addressing why ICER is doing this research. In media and many academic circles, ICER orbits as the independent, quasi-governmental agency helping us determine what responsible drug pricing would amount to.

In fact, ICER is overwhelmingly funded by Arnold Ventures. This organization invests heavily in political and research campaigns targeting drug developers for their pricing. Unfortunately, ICER does not focus its health economic analyses on the much larger cost burdens in US healthcare that occur outside of the pharmaceutical benefit. In its report “Unsupported Price Increases,” ICER acknowledges that funding from Arnold Ventures enabled the analysis at hand.

We need multiple voices in this debate, including views outside the pharmaceutical industry. But, we also must be aware who produces these. ICER is not a public advocate, nor is it mandated to provide objective, academic analyses. Unfortunately, in trying to grab headlines, the recent ICER report picked data points to support a narrative. There is no reason ICER cannot provide one of the perspectives in the debate, and do so with a credible point of view. We may just want to stop elevating that one voice as the ‘independent one’ in the important discussion of drug pricing.

What do you think? What are your organization’s perspective and pain points around healthcare value assessments in the US? Please drop me a line to discuss further.

References

- Shrank WH, Rogstad TL, Parekh N. Waste in the US Health Care System: Estimated Costs and Potential for Savings. JAMA. Published online October 07, 2019322(15):1501–1509. doi:10.1001/jama.2019.13978

- Abutaleb, Yasmeen. “FDA’s Gottlieb Blames Industry ‘Kabuki Drug Pricing’ for High Costs.” Reuters, Thomson Reuters, 7 Mar. 2018, reuters.com/article/us-usa-healthcare-gottlieb/fdas-gottlieb-blames-industry-kabuki-drug-pricing-for-high-costs-idUSKCN1GJ29H.

- Rind, David M, et al. “Unsupported Price Increase Report.” Unsupported Price Increase Report, Institute for Clinical and Economic Review, 8 Oct. 2019, icer-review.org/wp-content/uploads/2019/01/ICER_UPI_Final_Report_and_Assessment_100819_Final.pdf.